All Categories

Featured

In 2020, an estimated 13.6 million united state households are accredited financiers. These homes control massive wealth, estimated at over $73 trillion, which represents over 76% of all exclusive wealth in the U.S. These investors take part in financial investment chances normally unavailable to non-accredited investors, such as financial investments secretive business and offerings by certain hedge funds, private equity funds, and endeavor resources funds, which permit them to expand their riches.

Read on for details concerning the current recognized investor alterations. Resources is the fuel that runs the financial engine of any kind of nation. Banks typically money the majority, however rarely all, of the capital called for of any type of acquisition. There are circumstances like start-ups, where financial institutions do not provide any kind of funding at all, as they are unverified and thought about dangerous, yet the demand for resources stays.

There are largely two policies that allow providers of safeties to offer unlimited quantities of safety and securities to financiers. accredited investor registration. Among them is Guideline 506(b) of Law D, which allows a provider to offer safeties to unlimited certified financiers and approximately 35 Sophisticated Investors just if the offering is NOT made with general solicitation and general advertising

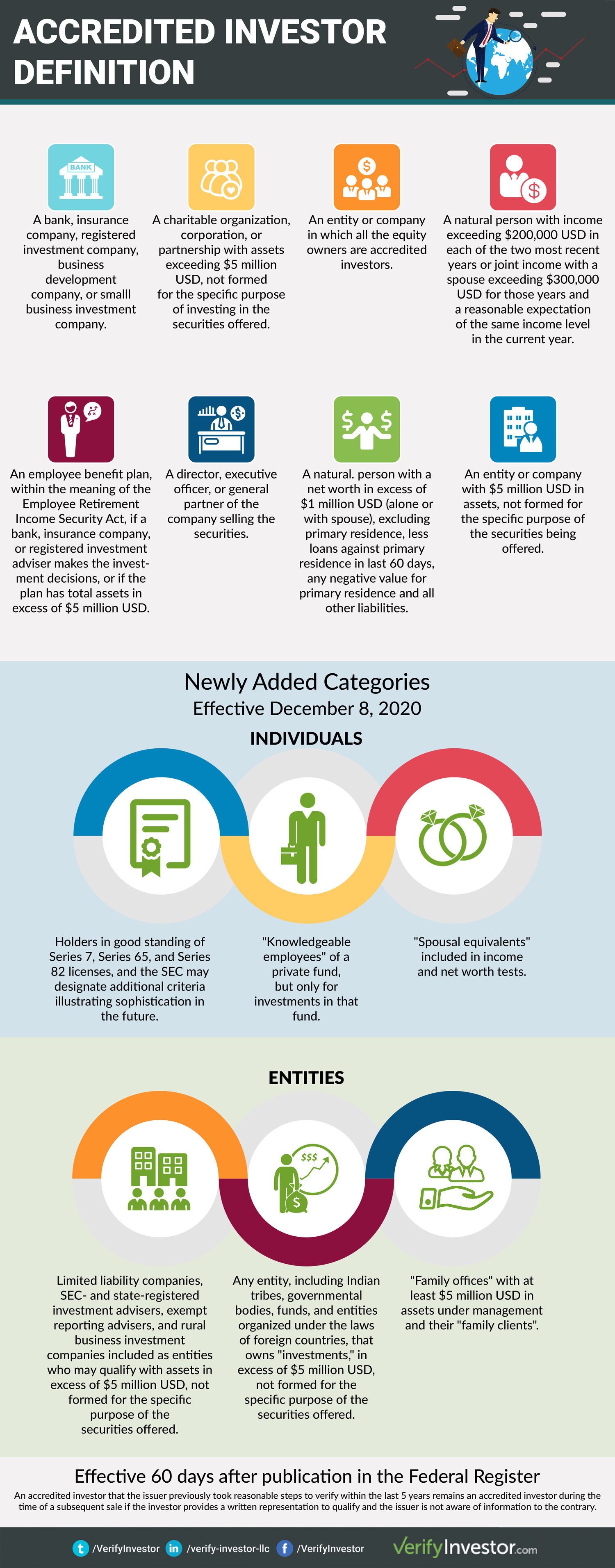

The newly adopted changes for the initial time accredit specific financiers based on monetary sophistication demands. The amendments to the recognized financier definition in Rule 501(a): consist of as accredited financiers any depend on, with complete properties more than $5 million, not developed particularly to buy the subject safeties, whose purchase is directed by a sophisticated person, or include as certified investors any type of entity in which all the equity owners are certified financiers.

There are a number of enrollment exceptions that inevitably increase the universe of possible financiers. Numerous exemptions need that the financial investment offering be made only to individuals that are certified financiers (accredited investor leads).

In addition, recognized financiers commonly obtain extra beneficial terms and higher prospective returns than what is offered to the basic public. This is since exclusive positionings and hedge funds are not called for to adhere to the exact same governing needs as public offerings, enabling for more flexibility in terms of financial investment approaches and prospective returns.

Akkreditierter Investor

One reason these protection offerings are limited to approved capitalists is to guarantee that all taking part capitalists are economically sophisticated and able to fend for themselves or sustain the risk of loss, therefore making unneeded the securities that come from a licensed offering.

The net worth examination is reasonably straightforward. Either you have a million bucks, or you don't. On the revenue examination, the individual needs to satisfy the limits for the 3 years regularly either alone or with a spouse, and can not, for example, satisfy one year based on private income and the following 2 years based on joint earnings with a spouse.

Latest Posts

Buying Land For Taxes Owed

Tax Default Real Estate

Tax Lien And Tax Deed Investing