All Categories

Featured

In 2020, an approximated 13.6 million U.S. houses are approved capitalists. These families control huge wide range, approximated at over $73 trillion, which represents over 76% of all private riches in the U.S. These financiers take part in investment opportunities usually not available to non-accredited investors, such as investments secretive business and offerings by specific hedge funds, personal equity funds, and equity capital funds, which enable them to grow their wide range.

Review on for information regarding the most up to date recognized investor modifications. Capital is the gas that runs the financial engine of any type of country. Banks typically money the bulk, yet rarely all, of the funding needed of any kind of purchase. There are scenarios like startups, where financial institutions do not give any type of funding at all, as they are unproven and considered risky, but the need for resources remains.

There are mainly two policies that allow companies of protections to provide limitless quantities of securities to investors. stock investor definitions. One of them is Policy 506(b) of Law D, which permits a company to offer securities to unrestricted accredited financiers and up to 35 Innovative Financiers only if the offering is NOT made through basic solicitation and basic advertising and marketing

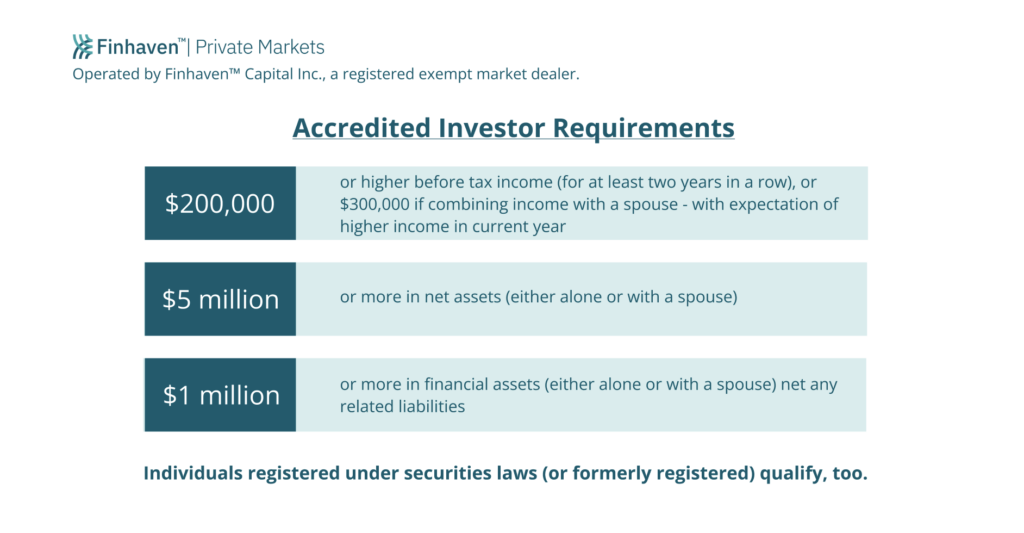

The newly adopted amendments for the initial time accredit specific investors based on economic elegance needs. The modifications to the recognized investor definition in Rule 501(a): include as certified capitalists any type of count on, with overall assets a lot more than $5 million, not developed especially to purchase the subject safeties, whose acquisition is guided by a sophisticated individual, or include as certified investors any kind of entity in which all the equity owners are certified capitalists.

There are a number of registration exceptions that ultimately broaden the world of possible capitalists. Lots of exceptions require that the financial investment offering be made just to persons that are certified capitalists (apply to be accredited investor).

In addition, accredited capitalists usually obtain extra desirable terms and greater potential returns than what is readily available to the basic public. This is since exclusive placements and hedge funds are not required to comply with the same regulatory needs as public offerings, permitting even more flexibility in regards to investment techniques and prospective returns.

Accredited Investor

One factor these safety offerings are limited to recognized capitalists is to ensure that all taking part capitalists are economically advanced and able to fend for themselves or sustain the risk of loss, thus providing unneeded the defenses that come from a licensed offering.

The web worth test is reasonably easy. Either you have a million dollars, or you don't. Nevertheless, on the earnings test, the individual has to please the thresholds for the 3 years constantly either alone or with a spouse, and can not, for instance, please one year based upon individual income and the following 2 years based on joint earnings with a spouse.

Latest Posts

Buying Land For Taxes Owed

Tax Default Real Estate

Tax Lien And Tax Deed Investing